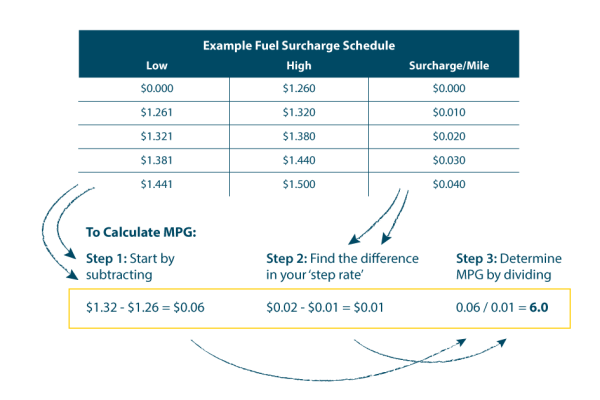

Base Rate Basics: Maximize Fuel Efficiency Savings and More | Breakthrough | Strategic Transportation Solution Provider

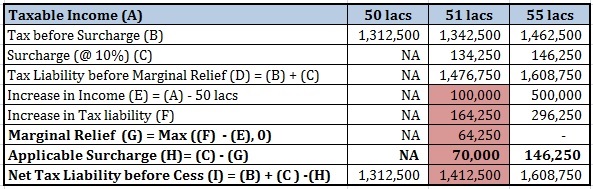

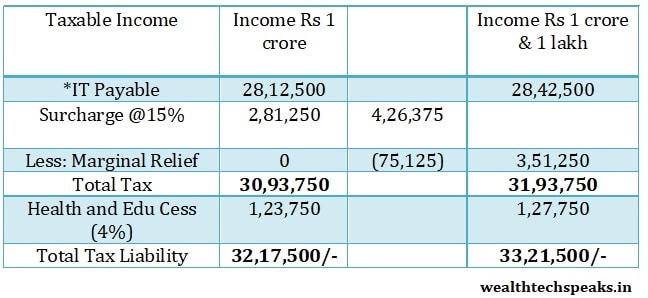

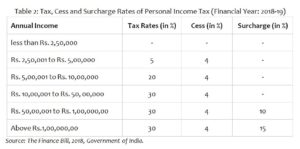

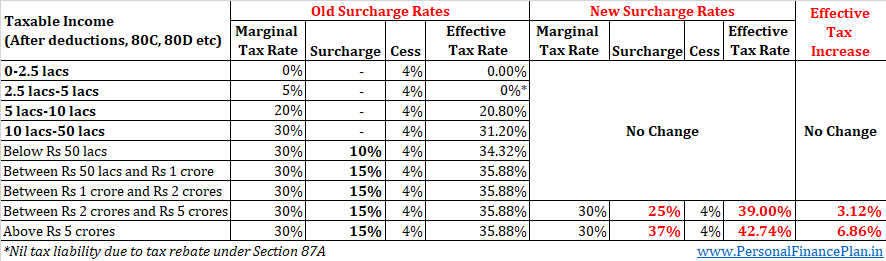

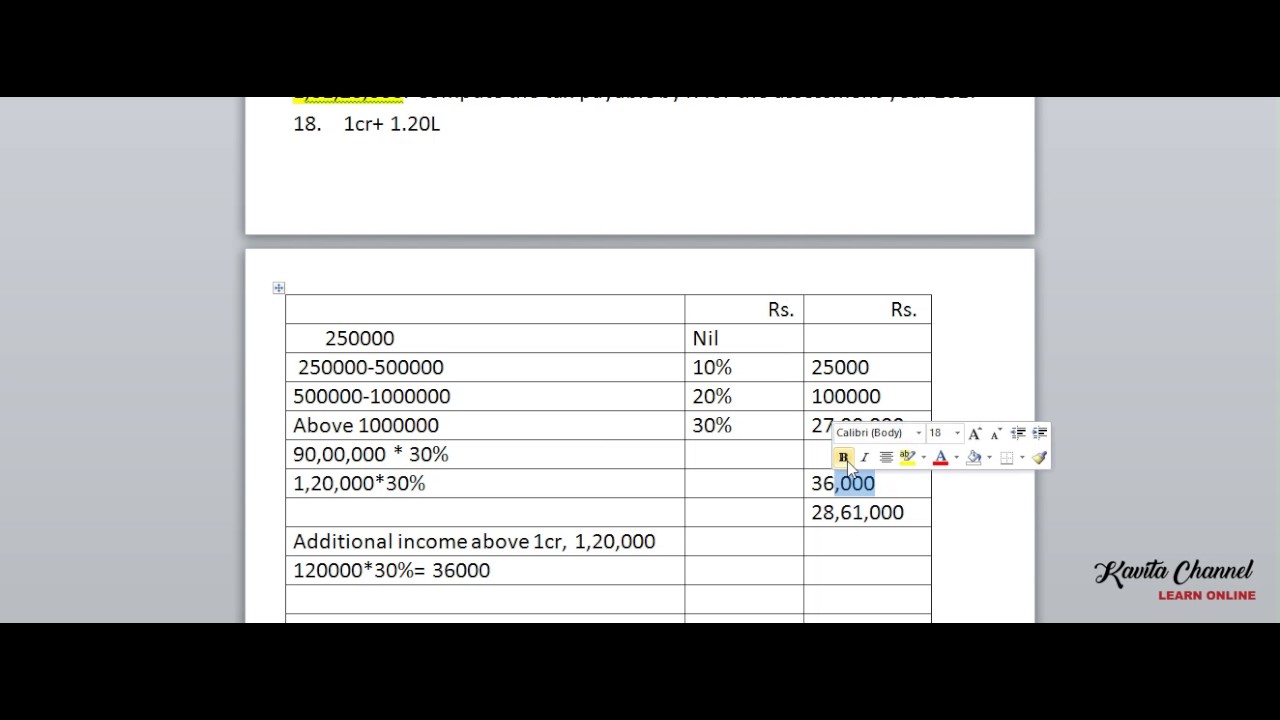

CA Harshil sheth on Twitter: "Day 9 #IncometaxseriesbyHarshil Topic 15 - Tax slabs in Old scheme & in New scheme, Surcharge, Marginal relief Topic 16 - table showing Max. Income calculation where

Surcharge Income Tax Calculation Ppt Powerpoint Presentation Infographic Template Graphics Cpb | Presentation Graphics | Presentation PowerPoint Example | Slide Templates

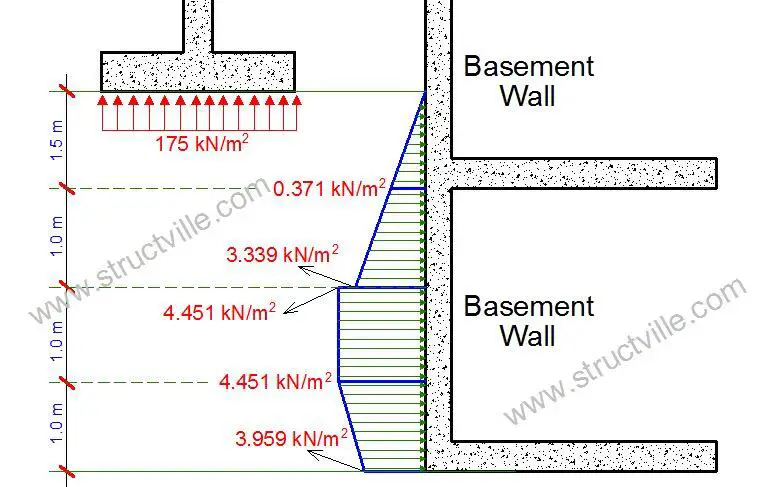

![Loads and Forces Acting on Retaining Wall and Their Calculations [PDF] - The Constructor Loads and Forces Acting on Retaining Wall and Their Calculations [PDF] - The Constructor](https://i0.wp.com/theconstructor.org/wp-content/uploads/2016/11/active-forces-on-retaining-wall.jpg?w=1170&ssl=1)

![Income Tax Calculation 2022-23 Excel Calculator [VIDEO] - FinCalC Blog Income Tax Calculation 2022-23 Excel Calculator [VIDEO] - FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2022/02/income-tax-calculation-2022-23-excel-formula-using-calculator-video-examples.webp)